property tax in france 2019

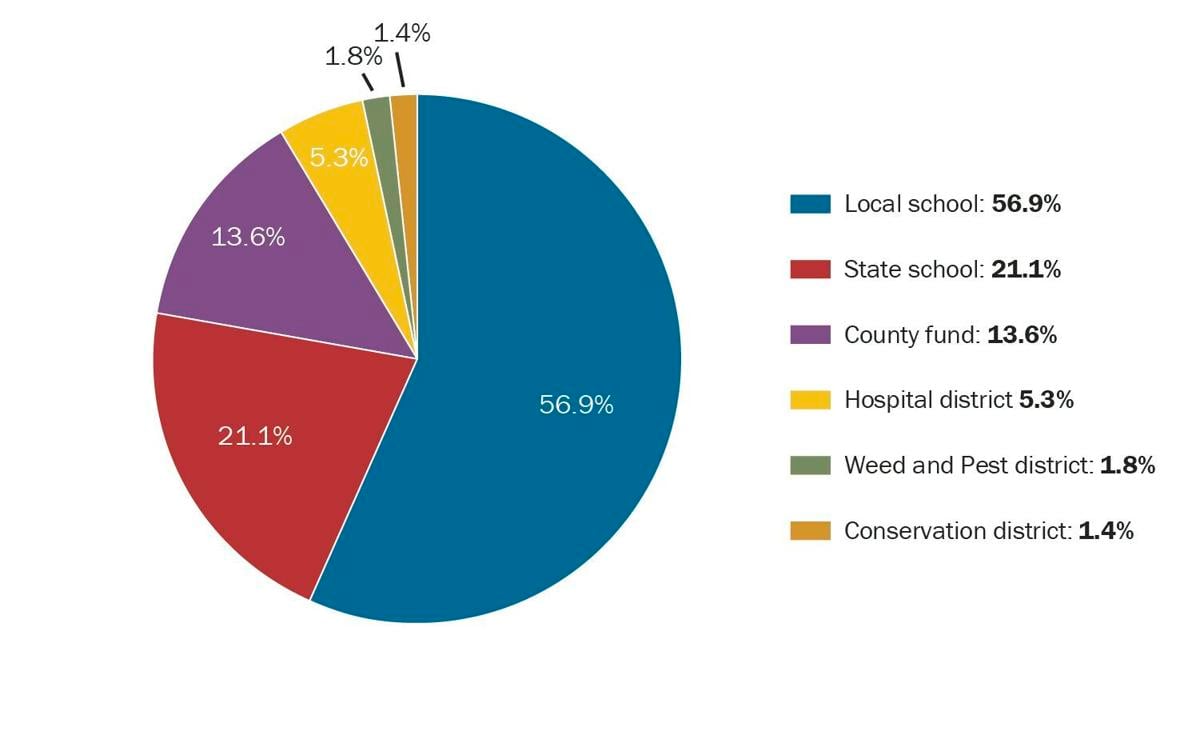

These include a departmental tax usually 45 of the purchase price as well as a communal tax at the rate of 120 and another government charge of 237. The maximum income levels based on 2019 income is 11098 for the first family quotient.

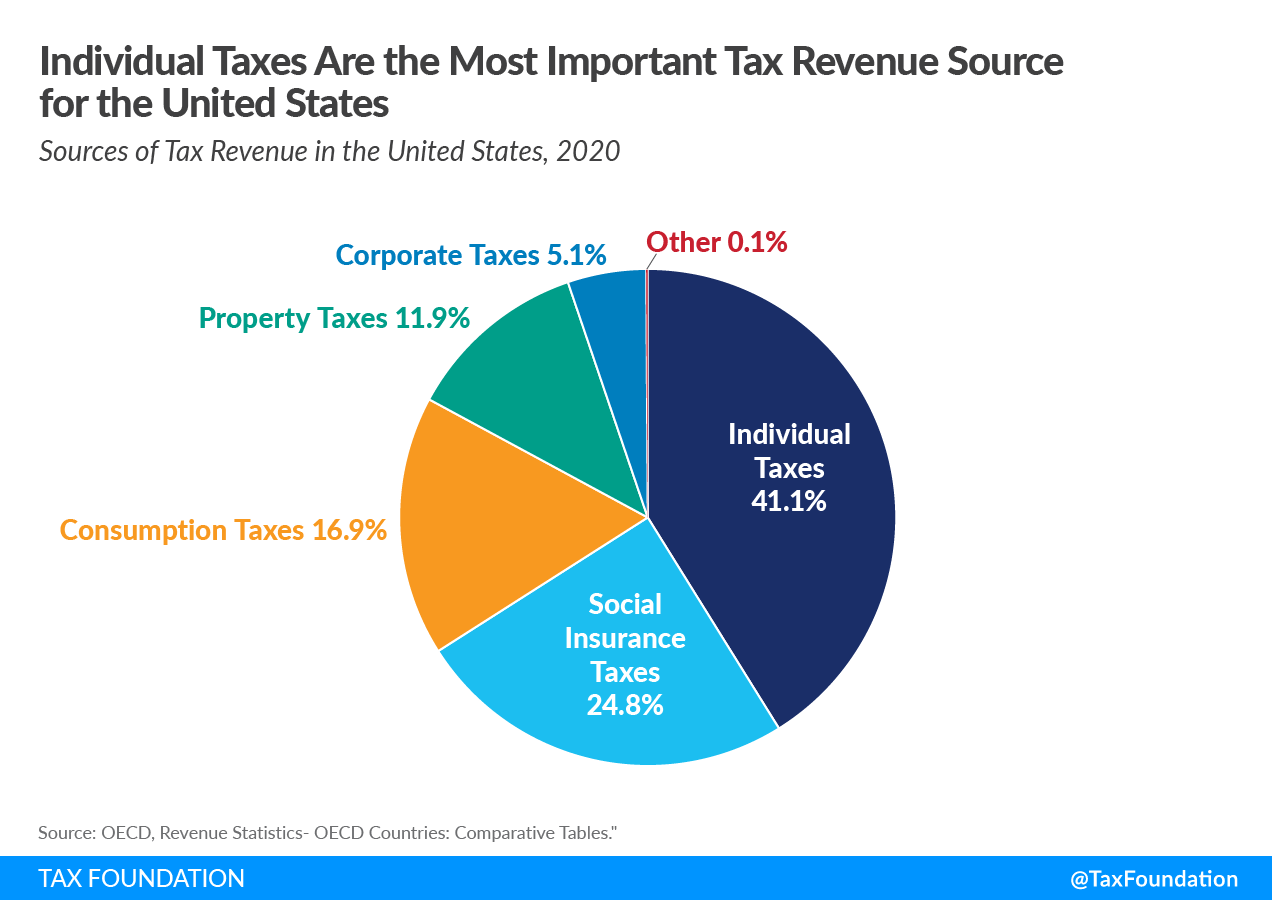

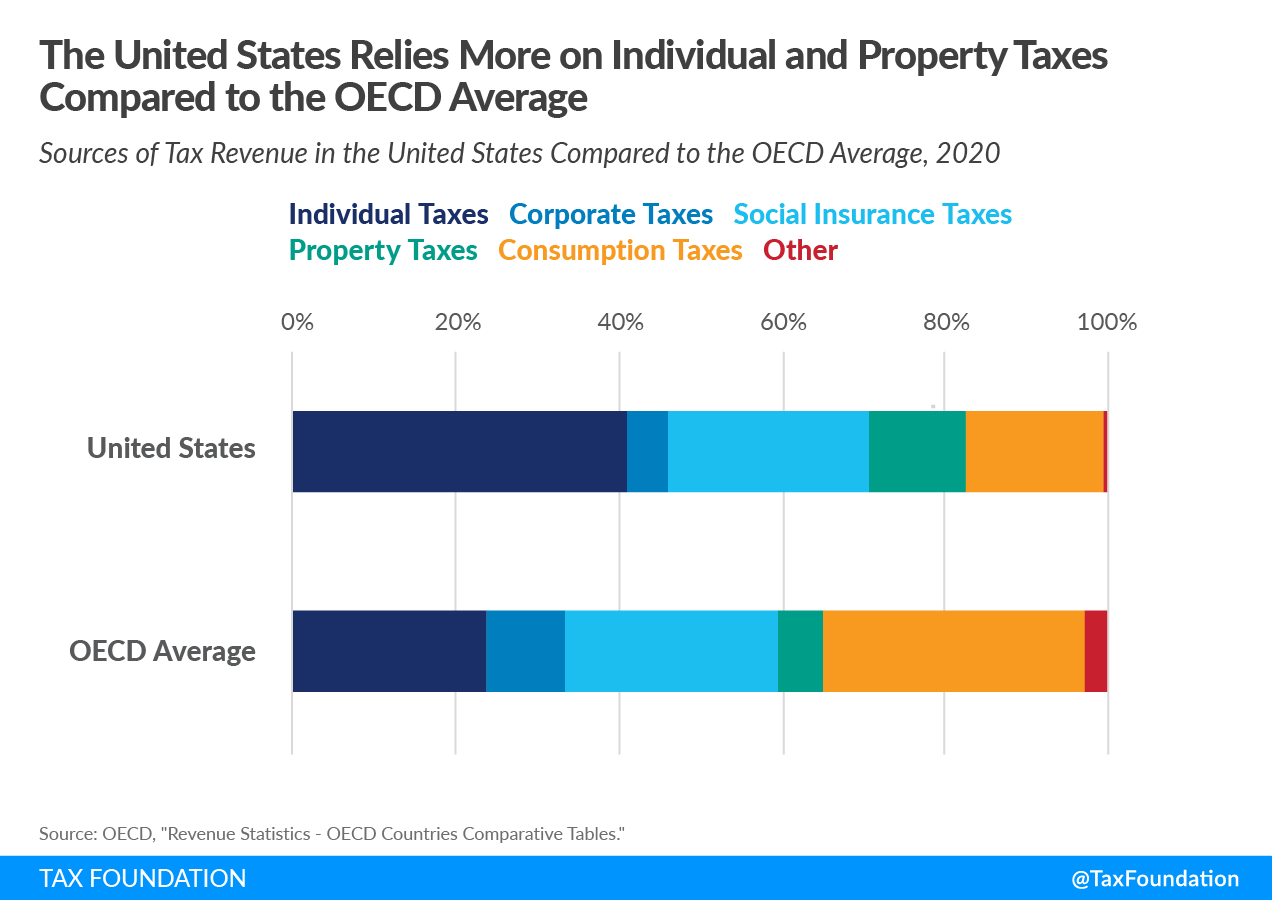

Property Taxes Property Tax Analysis Tax Foundation

Over this period revenue from taxes increased steadily reaching almost 88 billion.

. To provide relief from double inheritance taxes France has entered into estate tax treaties with 37 countries. Abolition of the Taxe dHabitation. Its important to keep in mind that this tax calculator is meant to be an estimation of your tax burdern and not a precise number.

The basis of tax is the price if the real estate is transferred against payment and the market value in other cases. Thats why we have created this tool in order to help you estimate your personal income tax burdern in France based on the latest fiscal data from the French authorities for 2019. So the difference between the price you bought it for and the price you sell it for.

This graph presents the total revenue generated by income taxes in France from 2006 to 2019 in million euros. The rate is 509 580 for real estate located in France variable according to where it is located and 5 for real. As we have previously reported in the Newsletter one of the two local property rates the taxe dhabitation is being abolished on the principal residence.

To find out more please refer to the International section of the website concerning nonresident individuals. Email your questions to editors. So if youre selling a property in France you could end up paying a rather hefty.

Its made up of a flat income tax rate of 19 plus 172 in social charges. The withholding tax system applies to wages pension payments and unemployment allowances paid by the. Friday 08 November 2019.

There are two other taxes that you will find added to your property tax bills. France is notorious for being one of the highest tax-paying countries in Europe so it should come as no surprise that as there are taxes to pay as a French homeowner. From 1 January 2019 French income tax for resident taxpayers is paid via the French withholding tax system.

The main developments this year concerning the fast disappearing local residence tax in France the taxe dhabitation. DINR PART - March 10 2021. There may be a slight differences.

Wealth tax IFI Even if you are no longer a resident of France for tax purposes you are still liable for weath tax impôt sur la fortune immobilière on your assets located in France.

Property Taxes Could Soar 30 To 50 Business Jhnewsandguide Com

Property Taxes Property Tax Analysis Tax Foundation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Taxes In France A Complete Guide For Expats Expatica

Taxes In France A Complete Guide For Expats Expatica

Property Taxes Property Tax Analysis Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

Feature Your Property At Europe S Premier Real Estate Event Exp Commercial Brokerage Real Estate Commercial Real Estate Real Estate Sales

Property Taxes Property Tax Analysis Tax Foundation

Taxes In France A Complete Guide For Expats Expatica

Property Taxes Property Tax Analysis Tax Foundation

Will County Announces Property Tax Relief Measures For 2020 Estate Tax Property Tax County

French Taxes I Buy A Property In France What Taxes Should I Pay

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

French Taxes I Buy A Property In France What Taxes Should I Pay

In Depth Guide To French Property Taxes For Non Residents Expats

Estate Inheritance And Gift Taxes In Europe Laura Strashny

Immovable Property Where Why And How Should It Be Taxed Suerf Policy Notes Suerf The European Money And Finance Forum

An Overview Of The Taxation Of Residential Property Is It A Good Idea Public Sector Economics